Debt Reduction Maroochydore

- Financial Advice For Everyone

- Licensed under Infocus Securities Pty Ltd (AFSL 236523)

- Supporting Sunshine Coast clients since 2018

Contact Us

Contact Us

Thank you for contacting Sunshine Coast Financial Advisers.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

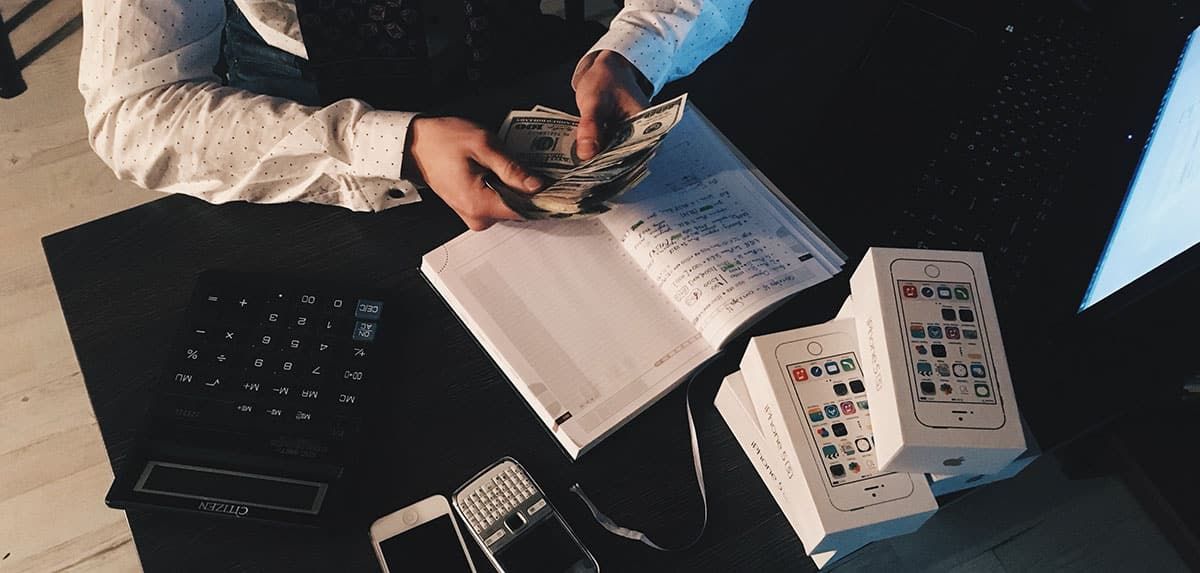

Effectively Reduce Your Debt

If you’ve got a mortgage, car loan, or investment loan, our Maroochydore financial advisers can assist you on the most effective methods to help reduce your debts. This can be of fundamental importance when working on your overall financial goals and growing your wealth. Working with all clients throughout the Sunshine Coast, including Caloundra, Caboolture, Noosa, Maroochydore and Mooloolaba, the team at Sunshine Coast Financial Advisers is here to assist in all matters relating to effective debt reduction.

While many of us would love to live without debt, there are many instances where debt is in fact a common tool for investing in assets, especially a home, or other investments. A key component to debt is ensuring that your debt is tax-effective and not controlling your life. Our financial advisers can best recommend how to turn debt into a positive strategy, while designing a tailored plan for debt reduction. Our qualified crew will help ensure that you are on the right track.

Identifying Your Opportunities

Effective debt management goes hand-in-hand with a proper cash flow management plan. Our professional team will work closely with you, analysing your income, expenses and daily cash flow. From here, we can identify opportunities to create surplus income and advise on how to best utilise those funds – either to build up a cash reserve, boost your superannuation, or pay down debt.

According to a recent report, Australians are accumulating more debt. What’s more, the difference between what people owe and earn has almost tripled over the last thirty years. However, debt can have its advantages. Having ‘good debt’ can be a healthy financial choice if you are using the funds to invest in assets, such as property or shares that can help to generate additional income. If you’re interested in taking out a loan to fund an

investment

but want some tips and advice on how to stay on top of your repayments, speak with our Maroochydore financial advisers today. We can provide you with tailored advice and guide you through the world of debt reduction.

Build Your Wealth Today

Take control of your debt with Sunshine Coast Financial Advisers today. Rest assured you will be working with a local, qualified, and experienced team of financial advisers who will offer you the best possible advice. For further information on debt reduction strategies, speak with one of our team members today to book an initial complimentary consultation.

Frequently Asked Questions

What is debt reduction?

Debt reduction is the process of decreasing your debt balance. Refinancing and reorganising your debts can be strategies you could employ to reposition your debt for more efficient payoff.

How can I reduce my debt quickly?

There are several ways you can try to begin reducing your debts. This can include paying back more than the minimum payment, drafting up a budget, negotiating lower interest rates on your credit cards, as well as consolidating debts. Our trusted team can tailor a debt reduction plan that will effectively work to your needs.

What is good debt?

The primary difference between ‘good debt’ and ‘bad debt’ is the possibility for that debt to help you build wealth over time. Debt can become ‘good’ if you are utilising it to invest in an asset, such as property or shares, which may generate an income over time.